Emerging Enterprises

Banking

Positive customer experience is pivotal not just to a bank’s ability to grow business and increase revenue but also to maintaining its reputation and standing out in an increasingly competitive financial landscape. Customer demands are changing and keeping up with new consumer expectations requires banks to embrace digital transformation and deliver an online customer experience that consistently puts the client first.

Problem that Banks face is to turn the massive quantities of data they create or consume into valuable, actionable insights. Data analytics in banking is a powerful tool for improving performance, optimizing the customer experience, and growing revenue.

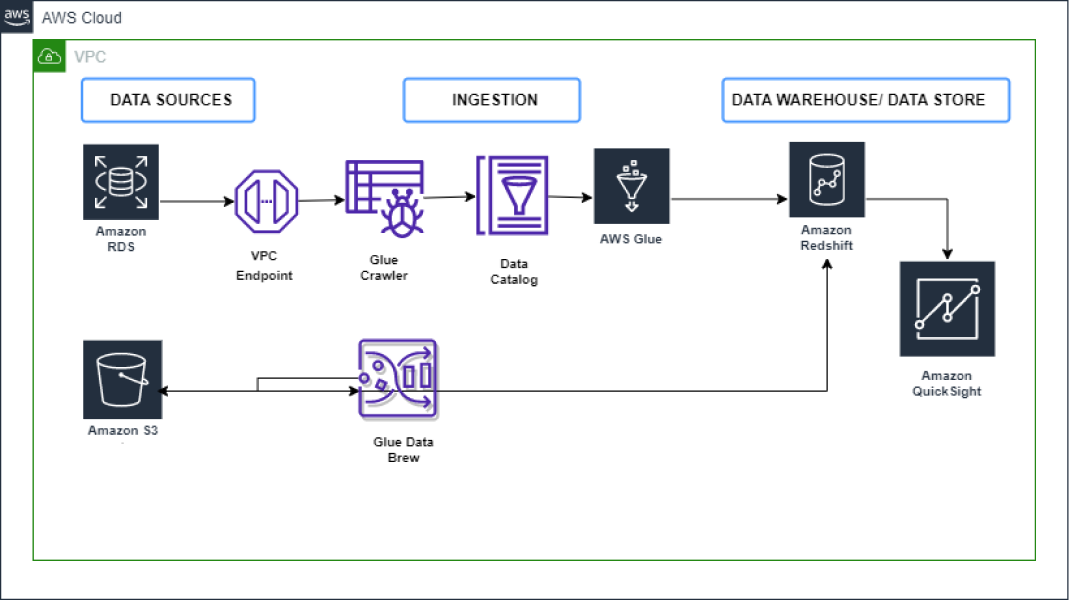

ATS Solution: Business Intelligence and Analytics Implementation using AWS

Services Used

Warehousing:

Amazon Web Services (AWS) offers several warehouse solutions for storing and managing large amounts of data.

Amazon Redshift: A fully managed, petabyte-scale data warehouse service that makes it easy to quickly analyse data using SQL and your existing business intelligence tools.

Amazon RDS: A fully managed relational database service that makes it easy to set up, operate, and scale a relational database in the cloud. It supports popular database engines such as MySQL, PostgreSQL, and Oracle.

Amazon S3: A fully managed object storage service that allows you to store and retrieve any amount of data, at any time, from anywhere on the internet. It can be used as a data lake for storing raw data for analytics and machine learning workloads.

Dashboard:

Amazon QuickSight is a business intelligence and data visualization service provided by Amazon Web Services (AWS).

It allows users to create and share interactive dashboards and visualizations of their data, using a drag-and-drop interface and pre-built templates.

It supports data sources such as Amazon Redshift, Amazon RDS, and Amazon S3, as well as other data sources via ODBC/JDBC connectors.

It also provides collaboration features such as sharing and commenting and allows for embedding visualizations in other applications.

Benefits of the Solution Provided

Manage vast amounts of collected data and provide their organizations with actionable insights. The insights would be developed through analytical disciplines to drive fact-based decision making.

DDDM improves planning, management, measurement, and learning.

Bring data together, efficiently provide analysis and reporting, and securely share the information that fuels business strategy.

Break free from manual processes trapped in spreadsheets to deliver the powerful analytics in entire organization.

Functional areas like Risk, Compliance, Fraud, NPA monitoring, and Calculating Value at Risk can benefit greatly from Analytics to ensure optimal performance, and to take crucial decisions where timing is very important.

High Level AWS Architecture

Banking Major KPIs

Revenue

Expenses

Operating Profit

Operating Expenses as a percentage of assets

Assets Under Management (AUM)

Percentage Of AUM Above

Benchmark Return On Equity

Return On Assets (ROA)

Client Survey Score

New Account Setup Error Rate

Total Volume Of Accounts

AUM Per Employee

Banking – Loan Disbursement

Dashboard Description

Overall Analysis gives a jumpstart to getting data driven insight into your Advances and Loan numbers. We get a better understanding of the volumes of transactions and clients.

Banking – Loan Disbursement