India’s move to a branded household

- Recent studies show that Indians are buying more branded foods. The demand for branded foods has gradually increased especially in rural areas. With the advent of the pandemic, this trend has shown a spike in recent times with a boost in online sales via e-commerce platforms. The Ministry of Food Processing Industries (MoFPI) predicts that by 2025, India’s food processing sector would to be worth over half a trillion dollars. Currently, at $35 million, the packaged foods market in India alone is expected to generate $70 million by 2023 according to Nestle India Chairman and MD.

- Due to this tremendous growth, FMCG industry Giants like Dabur and Marico were fast in seizing this opportunity. Dabur’s launch of 7 new products since Jan ’21 marked the entry into new product categories like ayurvedic tailam, apple cider vinegar shampoo, etc., and Marico’s entry into instant noodles under its Saffola Brand to take on Nestle, ITC in a Rs 4,000 cr market shows how aggressive brands have become. Marico’s instant noodles are the first big launch after the Maggi crisis. Six months back, Marico also launched its brand of honey products into a Rs 1,500-crore category dominated by Dabur.

- Traditionally, 90% of the Indian FMCG industry depended on the local Kirana and stores. People bought Vegetables and fruits in the market or at small shops. With the launch of supermarket chains like Ratnadeep, More Supermarket, and hypermarkets DMart and Spar, the urban population found these stores more convenient due to the availability of multiple products in one place. Due to fast-paced lives and lack of time, and with these stores strategically placed near malls and in huge standalone buildings with floors full of products, most of the working class now buy daily essential and non-essentials from these stores. Online stores too made an entry into the FMCG market boasting about a wide range of products, high discounts, and the added perk of home delivery thereby changing the traditional ways of buying regular household items.

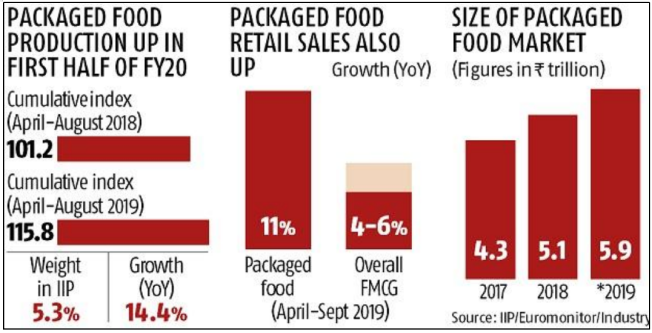

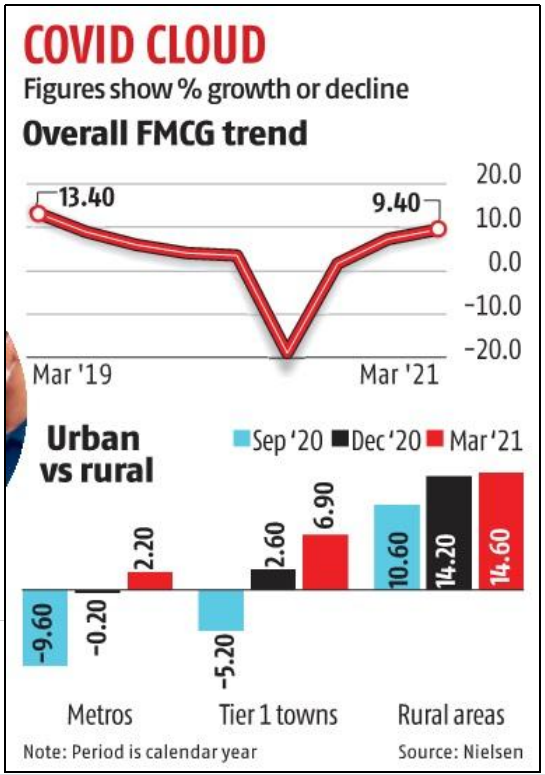

- Reports from NeilsenIQ states that the 4.3 trillion rupees Indian FMCG Industry grew by 9.4%. If e-commerce sales were excluded, the sector growth stood at 9.3% in the March quarter, 7.1% in the December quarter, and 0.8% in the September quarter. Factors contributing to this growth include changing demographics, evolving preferences for branded items, a modernizing retail sector, growing consumer acceptance of processed foods, and government advocacy to develop food manufacturing

India currently has about 140 million consumers using e-commerce apps. This number is expected to almost triple in the next 5-10 years. Total people accessing the internet, which is about 600-650 million, is expected to be a billion people by the end of 2025. This increase in usage of online grocery delivery apps can be attributed to the covid pandemic. With the sudden lockdowns and restrictions, people have migrated to online stores more than ever. With the option of essential, non-essential, gourmet foods, beauty product household products, online stores like Big Basket and Grofers have seen a growth in demand which peaked during last year’s lockdown. However, this demand has tapered off from the peak visible during the lockdown and unlock phases last year. From about 30.3% in the September 2020 quarter, e-commerce growth halved in March 2021, dropping to 15.7%. Due to the lockdown, Consumption growth was witnessed for certain categories in non-staple Foods categories such as snacks, ready to eat, and ready to cook meals. With the focus shifting toward ‘healthy and clean food’, Haldiram’s swiftly grabbed this opportunity by announcing a partnership with South African health food company, FutureLife in Feb 2021. They have launched a range of Smart Snacks, Smart Oats, and Ancient Grains, Crunchy Granola, and High Protein Foods starting with North India. Lockdown and safety concerns over restaurant food delivery have led to the rise in consumption of ready-to-cook meals, frozen snacks, instant mixes, batters, ice creams, and frozen desserts. Some Food Manufacturing brands like ITC, MTR claim to have seen an increase in consumption of these foods by 20% – 30%. Licious, meat products, and seafood brands saw a 300% jump in sales of their kebabs and ready-to-eat spreads in just the second quarter of 2021.

- A shift from unbranded to branded foods has been growing esp in the rural due to reverse migration. Rural retailers are stocking up more and more products. Currently, the number of categories stocked by rural retailers is 27.3 compared to 26.8 earlier. Besides, rural-centric schemes as bigger outlay for MGNREGA, rise in wages, and increase in MSP of key crops have been instrumental in keeping FMCG consumption in rural markets buoyant. However, some of the increase in demand has been attributed to the pandemic and lockdowns. With that slowly going back to normal and with people returning to work, this trend might slow down.

- With the Indian Government investing tremendously in Mega Food Parks and Manufacturing units, easing laws on FDIs and introducing new PLI schemes have enabled a lot of multinational food companies to invest in the trillion-dollar market Indian Food Market. Retail wars have started brewing among some of the biggest firms already established in the FMCG industry. There are more new entrants into the market than ever. The demand for branded foods has shot up since the pandemic. But will this trend continue once we go back to a pre-Covid lifestyle?